Fintech Future

Secure Your Financial Institution with Identity Verification

Prevent financial crime, establish trust, and increase customer conversion. Idenfication is dedicated to simplifying the identity verification process, enabling genuine individuals to get verified on their initial attempt while preventing financial fraud.

Utilizes cutting-edge AI technology to automate and expedite the identity verification process. By employing advanced document recognition, biometric analysis, and real-time data verification, we significantly reduce the manual effort required, enabling quicker and smoother verifications.

Idenfication is built with a strong focus on compliance with industry regulations and standards. Our system is designed to perform thorough checks, ensuring that you remain in line with AML and KYC regulations throughout the verification process.

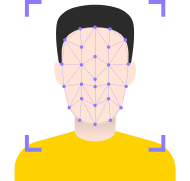

Our biometric analysis is highly accurate due to our advanced AI algorithms. We use various biometric indicators, such as facial recognition and fingerprint matching, to establish a comprehensive identity profile. This helps prevent fraudulent attempts and ensures that only legitimate users gain access.

How We Can Help?

Empowering Fintechs with Idenfication

Streamlining the process of identity verification while ensuring compliance has never been easier.

Effortless Onboarding

Leveraging cutting-edge AI and machine learning technologies, Idenfication offers a fully automated verification solution that delivers quick decisions within seconds.

Shield Against Fraudulent Activities

Using different technologies, we equip you with comprehensive insights to verify the authenticity of your customers, reducing the chances of fraudulent activities.

Data Extraction

Whether you require a basic automated ID check or a more advanced verification process involving selfies, and photo matching, Idenfication can adapt to your specific needs.

Flexible Scalability

Whether you require a basic automated ID check or a more advanced verification process involving selfies, and photo matching, Idenfication can adapt to your specific needs.

Compliance Made Easy

Whether you require a basic automated ID check or a more advanced verification process involving selfies, and photo matching, Idenfication can adapt to your specific needs.

Seamless Integration

Integrate Idenfication effortlessly into your new or existing product through our user-friendly API options. Our dedicated support ensure a smooth integration process.

Why Choose Us

To keep ahead of the curve, our team can help you revolutionise your business using the most recent AI verification techniques.

We offer competitive pricing for our services, which can help businesses save on costs while still getting high-quality digital identity verification and authentication services.

Artificial Intelligent Biometric Authentication

Confirm True Identities for Safety

24/7 Dedicated Support

Easy to Use and Integrate

Frequently Asked Question

FAQs About Fintech & ID Verification

Some common FAQs about Financial Institutions and Identity Verification

iDenfication is a cutting-edge identity verification solution designed specifically for the FinTech industry. It ensures secure and compliant customer onboarding by verifying the identities of users during financial transactions and interactions.

Identity verification is vital in FinTech to prevent fraud, money laundering, and unauthorized access. It enhances trust, regulatory compliance, and safeguards both customers and businesses.

iDenfication employs a multi-layered approach, combining document verification, biometric authentication, and AI-driven analysis to validate user identities. This ensures a comprehensive and accurate verification process.

Absolutely! iDenfication offers customization options, allowing you to tailor the verification process to your specific business requirements, user experience preferences, and compliance standards.

iDenfication enhances user experience by streamlining the onboarding process. Its quick and user-friendly verification procedure reduces friction, enabling customers to access financial services swiftly and securely.

iDenfication supports a wide range of identity documents, including passports, driver's licenses, national IDs, and other forms of identification that prominently feature your photograph, enabling global coverage and flexibility.

iDenfication boasts a high accuracy rate due to its advanced AI algorithms and machine learning capabilities. Its robust verification process minimizes false positives and negatives, enhancing reliability.

Yes, customer data security and compliance are paramount. iDenfication follows industry best practices, adheres to data protection regulations, and employs encryption to safeguard sensitive information.

Absolutely. iDenfication is designed to assist FinTech companies in meeting Know Your Customer (KYC), Anti-Money Laundering (AML), and other regulatory obligations by ensuring accurate and thorough identity verification.

Yes, iDenfication is designed for seamless integration with various FinTech platforms and systems through APIs. This facilitates a hassle-free implementation process.